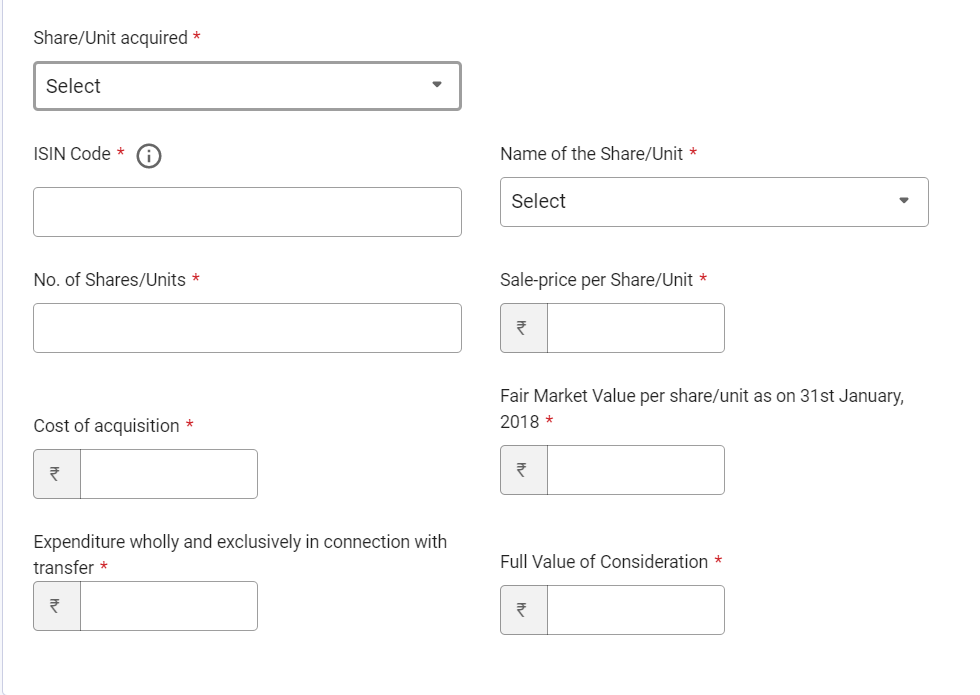

Section 112 a of Income Tax Act 2018 with Example |Long Term Capital Gain on Sale of Listed equity share | Latest Law and Tax Magazine and Books.

![Opinion] Whether Sec. 112(1)(c)(iii) Applicable to NR Supersede General Provisions of Computing Capital Gains? Opinion] Whether Sec. 112(1)(c)(iii) Applicable to NR Supersede General Provisions of Computing Capital Gains?](https://www.taxmann.com/post/wp-content/uploads/2023/05/5-1-1-1024x600.jpg)

Opinion] Whether Sec. 112(1)(c)(iii) Applicable to NR Supersede General Provisions of Computing Capital Gains?

If you have any questions about tax harvesting please let me know in comments section, will reply to all comments.#march #tax #taxseason... | Instagram

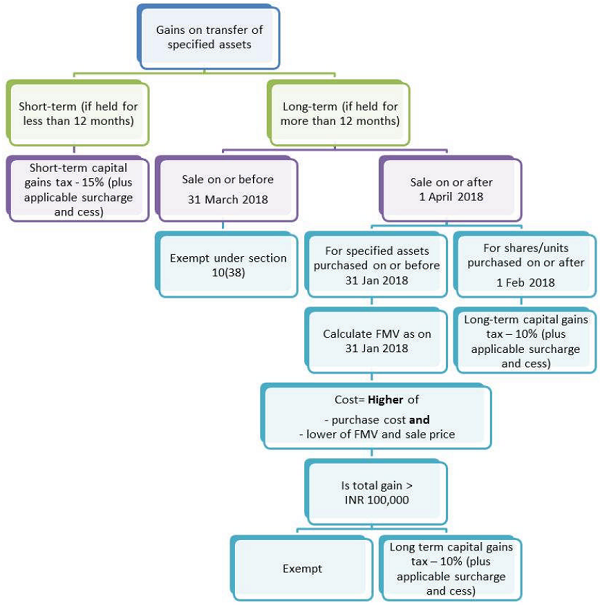

Understanding Section 111A and Section 112A of Income Tax Act: A Comprehensive Guide - Marg ERP Blog